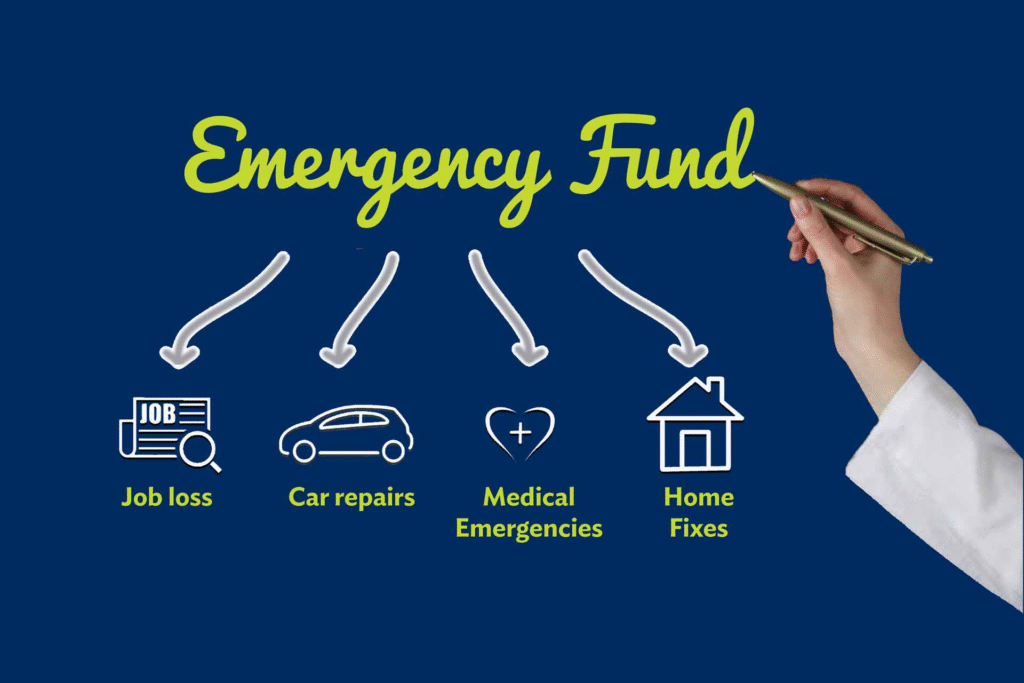

Life is unpredictable. One minute you’re coasting along comfortably, and the next, your car breaks down, a medical bill arrives, or your job is suddenly gone. These unexpected events can lead to financial chaos if you’re not prepared. That’s where an emergency fund comes in.

An emergency fund is a dedicated amount of money set aside to cover unforeseen expenses. It’s a financial safety net designed to keep you afloat during tough times without having to rely on high-interest debt like credit cards or payday loans.

Having an emergency fund gives you peace of mind, reduces financial stress, and helps you make better decisions during crises. In short, it’s one of the smartest and most essential steps toward financial stability.

Key Takeaways

- Aim to save 3–6 months of living expenses.

- Use a high-yield savings account for accessibility and growth.

- Start small and build gradually with consistent saving.

- Only use the fund for genuine emergencies.

- Replenish it promptly after use.

- Even while paying debt, a small emergency fund is essential.

- Separate it from your other savings goals.

How Much Should You Save in Your Emergency Fund?

The size of your emergency fund depends on your individual circumstances, but a good rule of thumb is to aim for 3 to 6 months’ worth of living expenses. This includes rent or mortgage, utilities, food, transportation, insurance, and minimum loan payments.

Factors That Influence Your Target Amount:

- Employment Stability: If you have a stable job, 3 months may be enough. Freelancers or self-employed individuals may want closer to 6-12 months.

- Health & Family Considerations: Chronic health conditions or dependents may require a larger cushion.

- Debt Levels: If you’re carrying high-interest debt, you might start with a smaller fund and aggressively pay down debt, then build your fund.

Where Should You Keep Your Emergency Fund?

| Account Type | Pros | Cons |

|---|---|---|

| High-Yield Savings Account | Easy access, higher interest than regular savings | May limit monthly withdrawals |

| Money Market Account | Competitive interest rates, check-writing privileges | Often requires a higher minimum balance |

| Cash Management Account | Combines savings/checking/investment features, good liquidity | Not available at traditional banks, may vary by broker |

| Regular Savings Account | Very accessible, widely available | Low interest rate |

| Cash at Home | Instant access in emergencies | No interest, security risks, not ideal for full fund |

Your emergency fund should be easily accessible but not so easy that you’re tempted to dip into it for non-emergencies. Ideal options include:

- High-Yield Savings Account: Offers better interest than a regular savings account while keeping your funds liquid.

- Money Market Account: Typically offers higher interest rates and check-writing privileges.

- Cash Management Accounts: Offered by brokerages, these accounts combine features of checking, savings, and investment accounts.

Avoid tying your emergency fund to investments like stocks or mutual funds, which can be volatile and not immediately liquid.

How Can You Start Building Your Emergency Fund?

Starting is often the hardest part. Here are the steps to get going:

1. Set a Realistic Goal

Break down your target amount into manageable chunks. Start with a goal of $500 or $1,000, then build from there.

2. Create a Budget

Identify areas where you can cut back and redirect those savings into your fund. Even $25 or $50 a week adds up.

3. Automate Savings

Set up automatic transfers from your checking account to your emergency fund. Treat it like a bill that must be paid monthly.

4. Use Windfalls Wisely

Tax refunds, bonuses, or gifts can be great opportunities to boost your fund quickly.

5. Sell Unused Items

Turn clutter into cash by selling things you no longer use on platforms like eBay, Facebook Marketplace, or Poshmark.

What Should Your Emergency Fund Be Used For?

Your emergency fund should only be used for genuine emergencies. Here are examples:

- Job loss

- Medical emergencies

- Major car or home repairs

- Unexpected travel (funeral, family crisis)

- Essential living expenses during a crisis

What Not to Use It For:

- Planned expenses like vacations or weddings

- Non-essential purchases like electronics or fashion

- Investments or business ventures

How Do You Rebuild Your Emergency Fund After Using It?

If you’ve dipped into your emergency fund, don’t worry. That’s what it’s there for. Here’s how to replenish it:

- Reassess Your Budget: Temporarily cut back on non-essentials.

- Increase Income: Consider side gigs, freelancing, or selling items.

- Redirect Other Savings: Pause other non-urgent savings goals and divert that money.

- Set a Timeline: Establish a goal for when you want your fund replenished and work backwards.

Can You Build an Emergency Fund While Paying Off Debt?

Yes, and you should. Start with a mini emergency fund of $500 to $1,000 while focusing on high-interest debt. Once your debt is more manageable, you can gradually increase your emergency savings.

It’s all about balance—protecting yourself from new debt while eliminating old debt.

Also Read : Why Financial Planning Is The Key To Long Term Wealth

Conclusion

An emergency fund isn’t just a savings account—it’s a financial fortress. It shields you from the chaos of life’s surprises and gives you the power to face challenges without going into debt. By setting clear goals, automating your savings, and being disciplined about its use, you’ll build a cushion that protects your peace of mind and future.

Whether you’re starting with $10 or $1,000, the most important step is to begin. Your future self will thank you.

Frequently Asked Questions

Can I keep my emergency fund in cash at home?

You can, but it’s not ideal. Keeping a small amount in cash (e.g., $100-$300) is okay for urgent needs, but most should be in a secure, interest-earning account.

What happens if I never use my emergency fund?

That’s a good thing! Think of it as insurance—you’re better off having it and not needing it than the other way around. Plus, it can grow over time.

How fast should I build my emergency fund?

As fast as your budget allows without sacrificing essential needs or racking up debt. Consistency is more important than speed.

Can I invest my emergency fund?

It’s not recommended. Emergency funds need to be stable and liquid. Investing introduces risk and potential delays in accessing your money.

Is $1,000 enough for an emergency fund?

It’s a great starting point, especially for those with high debt. Over time, aim to grow it to 3–6 months of living expenses.

Can I use my emergency fund for car repairs?

Yes—if the repair is essential to your ability to work or meet obligations, it qualifies as a legitimate emergency.

Should I have a separate emergency fund from my savings?

Yes. Your emergency fund should be dedicated solely to unexpected expenses, not mixed with savings for goals like vacations or home buying.