In an era where personal finance has taken center stage, investors — both beginners and seasoned — are constantly seeking ways to grow their wealth while minimizing risk. One of the most accessible and popular investment vehicles is the mutual fund. But what exactly are mutual funds, and how do they work?

Whether you’re new to investing or simply looking to expand your financial literacy, this comprehensive guide will help you understand the structure, benefits, types, and functionality of mutual funds in 2025 and beyond.

Key Takeaways

- Mutual funds offer an easy and accessible way to build wealth through diversified and professionally managed portfolios.

- They come in various types like equity, debt, hybrid, and index funds, each suited for different investment goals and risk appetites.

- Starting small with a Systematic Investment Plan (SIP) is a great way to build a disciplined investing habit.

- Always assess a fund’s expense ratio, risk profile, historical performance, and manager reputation.

- Mutual funds can be a core component of long-term financial planning, offering exposure to markets without needing to pick individual stocks.

What are Mutual Funds?

Mutual Funds are pools of money collected from many investors for the purpose of investing in stocks, bonds, or other securities. Mutual funds are owned by a group of investors and managed by professionals. In other words, a mutual fund is a collection of securities owned by a group of investors and managed by a fund manager.

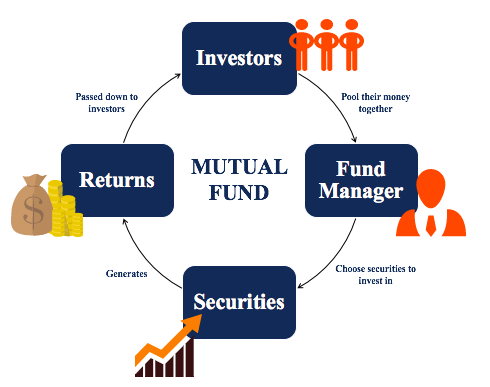

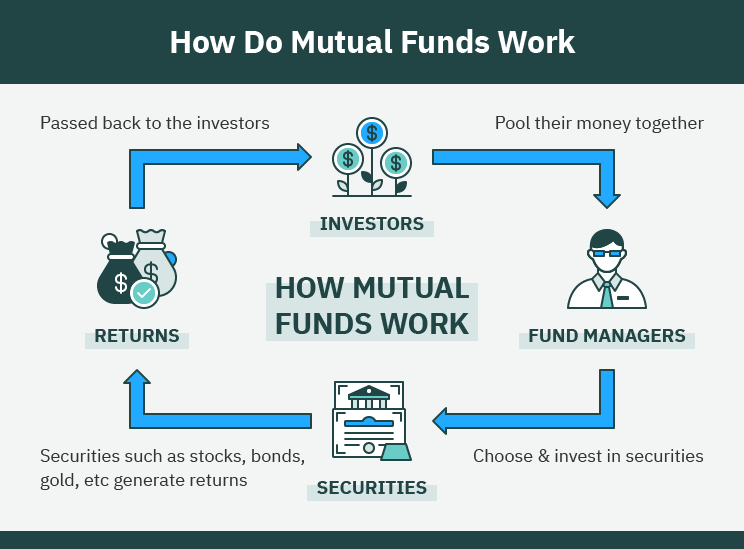

Understanding How Mutual Funds Work

When you purchase a mutual fund, you are pooling money with other investors. The money pooled together by you and other investors are managed by a fund manager who invests in financial assets such as stocks, bonds, etc. The mutual fund is managed on a daily basis. Below is a diagram of how mutual funds work:

Common Types of Mutual Funds

There are six common types of mutual funds:

1. Money Market Funds

Money market funds invest in short-term fixed-income securities. Examples of short-term fixed-income securities would be government bonds, Treasury bills, commercial paper, and certificates of deposit. These types of funds are generally a safer investment but with a lower potential return than other mutual funds.

2. Fixed Income Funds

Fixed income funds buy investments that pay a fixed rate of return. This type of mutual fund focuses on getting returns coming into the fund primarily through interest.

3. Equity Funds

Equity funds invest in stocks. Furthermore, there are different types of equity funds such as funds that specialize in growth stocks, value stocks, large-cap stocks, mid-cap stocks, small-cap stocks, or a combination of these stocks.

4. Balanced Funds

Balanced funds invest in a mix of equities and fixed-income securities – typically in a 40% equity 60% fixed income ratio. The aim of these funds is to generate higher returns but also mitigate risk through fixed-income securities.

5. Index Funds

Index funds aim to track the performance of a specific index. For example, the S&P, or TSX. Index funds follow the index and go up when the index goes up and goes down when the index goes down. Index funds are popular as they typically require a lower management fee compared to other funds (due to the manager not needing to do as much research).

6. Specialty Funds

Specialty funds focus on a very small part of a market such as energy, telecommunications, healthcare, industrials, etc.

Key Features of Mutual Funds

| Feature | Description |

|---|---|

| Accessibility | Start investing with as little as $100 or less |

| Liquidity | Buy or sell mutual fund units at NAV on any business day |

| Transparency | Regular disclosures about holdings and performance |

| Variety | Thousands of funds catering to different goals and risk levels |

| Cost-effective | Low minimum investments, especially with no-load funds |

Benefits of Investing in a Mutual Fund

There are several key benefits to investing in a mutual fund:

1. Diversification

Mutual funds spread investments across various assets, reducing the risk of major losses.

2. Professional Management

Fund managers actively manage portfolios, saving you time and offering expert insights.

3. Liquidity

You can redeem your investment on any business day and receive the funds within a few days.

4. Affordability

You don’t need a large sum to start investing. Many funds allow SIPs (Systematic Investment Plans) for as low as $10–$50 per month.

5. Transparency

Regulatory frameworks ensure funds disclose holdings, risks, and performance regularly.

6. Tax Efficiency

Certain funds like ELSS (Equity Linked Saving Schemes) in some countries offer tax benefits.

Disadvantages of a Mutual Fund

There are important disadvantages to consider when investing in a mutual fund:

1. Management Fees and Operating Expenses

Mutual funds typically charge a high MER (management fee and operating expenses). This would lower the overall return. For example, if the mutual fund posted a 1-year return of 10%, the MER would lower this return.

2. Loss of Control

Since mutual funds are managed by a manager, there is a loss of control when investing in a mutual fund. Remember that you are giving someone else your money to manage to when investing in a mutual fund.

3. Poor Performance

Mutual fund returns are not guaranteed. In fact, according to research, a large majority of mutual funds fail to beat major market indexes like the S&P 500. In addition, mutual funds are not insured against losses.

What to Consider Before Investing in Mutual Funds

- Your Investment Goals – Are you investing for retirement, a home, or a child’s education?

- Risk Tolerance – Can you handle short-term volatility for potentially higher returns?

- Time Horizon – Longer horizons suit equity funds; shorter ones may require debt or liquid funds.

- Fund Performance – Analyze historical returns but remember, past performance is not a guarantee.

- Expense Ratio – The cost of managing the fund; lower is generally better.

How Do Mutual Funds Work?

1. Pooling of Capital

When you buy a share of a mutual fund, your money is combined with that of other investors. This pool of capital is then used to invest in a wide array of assets.

2. Professional Management

A fund manager, supported by a team of analysts, selects securities that align with the fund’s stated investment strategy. Their goal is to maximize returns while managing risk.

3. NAV (Net Asset Value)

Mutual funds do not trade like stocks during the day. Instead, they are priced once daily at the Net Asset Value (NAV) — the total value of the fund’s assets minus liabilities, divided by the number of outstanding shares.

4. Diversification

Funds often invest in dozens or even hundreds of securities, reducing the risk associated with holding a single investment.

5. Returns

Investors can earn returns through:

- Dividends or interest from fund holdings.

- Capital gains from the sale of securities.

- Appreciation in NAV.

Risks Associated with Mutual Funds

While mutual funds offer many benefits, they are not without risk:

- Market Risk: Funds investing in equities are subject to market fluctuations.

- Interest Rate Risk: Debt funds may lose value if interest rates rise.

- Credit Risk: Debt funds investing in low-rated securities can default.

- Liquidity Risk: Some specialized funds may be harder to redeem quickly.

- Management Risk: The fund manager’s poor decisions may affect returns.

Also Read : What Are the Best Investments to Make in 2025?

Conclusion

Mutual funds are one of the most versatile and efficient investment tools available today. Whether you’re saving for retirement, planning for your child’s education, or just aiming to grow your wealth, mutual funds offer a solution for nearly every financial goal.

With low barriers to entry, diversification, and the support of professional management, mutual funds are an ideal starting point for anyone looking to begin or expand their investment journey in 2025. By staying informed and regularly reviewing your investments, you can make the most of what mutual funds have to offer — and move closer to financial freedom.

FAQs

Are mutual funds safe?

Mutual funds are relatively safe due to diversification and regulation, but they do carry risks based on the asset class (equity, debt, etc.).

Can I lose money in mutual funds?

Yes, especially in equity funds during market downturns. However, risk is mitigated with long-term investing and diversification.

How do mutual fund managers make decisions?

They analyze market conditions, company fundamentals, and economic trends to select and rebalance the portfolio.

What is the difference between active and passive mutual funds?

Active funds are managed by fund managers trying to outperform the market. Passive funds, like index funds, simply replicate a benchmark.

How are mutual funds taxed?

Taxation varies by region but typically depends on the holding period. Long-term and short-term capital gains are taxed differently.

Can I switch between mutual funds?

Yes. Most fund platforms allow you to switch between funds within the same AMC (Asset Management Company), though it may have tax implications.

What happens if the fund manager changes?

While it’s not uncommon, it’s wise to monitor how the fund performs after a manager change, as it may affect the investment style or results.